Stripe Payment Integration is a must for modern businesses. It simplifies online transactions and boosts sales.

Integrating Stripe into your website can streamline payment processes, making it easier for customers to complete purchases. This user-friendly payment gateway supports various payment methods, enhancing convenience for both merchants and buyers. A seamless payment experience can significantly impact customer satisfaction and loyalty.

By setting up Stripe, businesses can enjoy secure transactions and reduce the risk of payment fraud. In this blog post, we’ll explore the essentials of Stripe Payment Integration, from setup to benefits. Whether you’re a small business owner or an e-commerce giant, understanding Stripe’s capabilities can help you optimize your payment system and drive growth. Let’s dive in!

Introduction To Stripe

Stripe is a popular payment gateway for online businesses. It allows you to accept payments over the internet. Stripe is known for its ease of use and powerful features. Let’s dive into what makes Stripe a great choice for payment integration.

What Is Stripe?

Stripe is a technology company that builds economic infrastructure for the internet. Companies of all sizes use Stripe’s software and APIs to accept payments. Stripe also handles payouts and manages their online businesses.

Stripe was founded in 2010 by Patrick and John Collison. It has grown into one of the most trusted payment processors. It supports many payment methods including credit and debit cards, ACH transfers, and more.

Benefits Of Using Stripe

There are several benefits to using Stripe for your online payments:

- Ease of Integration: Stripe offers simple, developer-friendly APIs. This makes it easy to integrate into your website or app.

- Security: Stripe is PCI DSS compliant. It ensures that your customers’ payment data is handled securely.

- Global Reach: Stripe supports payments in over 135 currencies. This allows you to reach customers worldwide.

- Transparent Pricing: Stripe’s pricing is straightforward with no hidden fees. You pay a flat rate per transaction.

- Advanced Features: Stripe offers features like subscription billing, invoicing, and fraud prevention.

Below is a table summarizing some of the key features of Stripe:

| Feature | Description |

|---|---|

| Payment Methods | Supports credit cards, debit cards, ACH transfers, and more |

| Security | PCI DSS compliant, ensuring secure handling of payment data |

| Global Support | Supports payments in over 135 currencies |

| Subscription Billing | Offers tools for managing subscription payments |

| Fraud Prevention | Includes advanced fraud detection and prevention features |

Credit: stripe.com

Setting Up Your Stripe Account

Integrating Stripe into your website allows you to accept payments easily. The first step is setting up your Stripe account. This section will guide you through creating an account and configuring your settings.

Creating An Account

To start, visit the Stripe website and click on the Sign Up button. You will need to provide basic details like your email address and create a password.

After entering your details, click on the Create Account button. Stripe will send a verification email to the address you provided. Open the email and click on the verification link to activate your account.

Once your account is verified, you can log in to the Stripe dashboard. This is where you will manage your payment settings and track your transactions.

Configuring Account Settings

Now that your account is active, it’s time to configure your settings. Start by navigating to the Account Settings section in the dashboard.

Here, you can fill out important information about your business. This includes your business name, address, and contact information. Make sure to enter accurate details as this information will be used for your payment processing.

Next, set up your bank account to receive payments. Go to the Bank Accounts section and click on Add Bank Account. Enter your bank account details and save the changes. This allows Stripe to transfer funds directly to your bank.

You can also configure your email notifications in the settings. Choose how you want to receive updates about your transactions and account activity.

| Setting | Description |

|---|---|

| Business Information | Enter your business name, address, and contact details. |

| Bank Account | Add and verify your bank account for payments. |

| Email Notifications | Configure how you receive updates about transactions. |

You have successfully set up your Stripe account. You can now move on to integrating Stripe with your website.

Api Keys And Security

Integrating Stripe into your website is an excellent way to streamline online payments. To ensure smooth and secure transactions, understanding API keys and security is crucial. This section will cover how to obtain API keys and the best practices for maintaining their security.

Obtaining Api Keys

To start using Stripe, you need to obtain API keys. These keys allow your website to communicate with Stripe’s servers.

- Log in to your Stripe account.

- Navigate to the Developers section in the dashboard.

- Under API keys, you will find two types of keys:

- Publishable Key: Used on the client-side.

- Secret Key: Used on the server-side.

- Copy these keys and store them securely.

Ensuring Security

Maintaining the security of your API keys is essential to protect your transactions and user data. Here are some best practices:

- Never share your Secret Key publicly.

- Use environment variables to store your keys securely in your codebase.

- Regularly rotate your API keys to minimize risk.

- Monitor your API usage to detect any suspicious activity.

- Implement webhooks to receive real-time updates on payment events.

- Use SSL encryption to secure data transmission.

Following these practices will help you maintain a secure and reliable payment system. Remember, the safety of your transactions and user data is paramount.

Integrating Stripe With Your Website

Integrating Stripe into your website can streamline your payment processes. Stripe offers a simple and secure way for customers to pay. This guide will help you integrate Stripe into your site. We will cover the basics and provide practical steps.

Adding Stripe To Your Site

To add Stripe to your website, follow these steps:

- Sign up for a Stripe account: Go to the Stripe website and create an account.

- Get your API keys: After logging in, navigate to the API section. You’ll find the keys you need for integration.

- Install Stripe library: Add the Stripe library to your project. You can do this using npm or a CDN link.

Here is an example of adding Stripe using a CDN:

Next, add a payment form to your site:

Now, create a JavaScript file to handle the payment:

var stripe = Stripe('your-publishable-key');

var elements = stripe.elements();

var card = elements.create('card');

card.mount('#card-element');

document.getElementById('payment-form').addEventListener('submit', function(event) {

event.preventDefault();

stripe.createToken(card).then(function(result) {

if (result.error) {

// Show error in payment form

} else {

// Send the token to your server

}

});

});Testing The Integration

Before going live, it’s important to test your Stripe integration:

- Use Stripe’s test mode: In your Stripe dashboard, switch to test mode. This allows you to test payments without real money.

- Test with test card numbers: Stripe provides test card numbers to simulate transactions. Use these to check different scenarios.

- Check for errors: Ensure your form handles errors gracefully. Test invalid card numbers and expired cards.

Here are some test card numbers:

| Card Number | Description |

|---|---|

| 4242 4242 4242 4242 | Successful payment |

| 4000 0000 0000 0002 | Card declined |

| 4000 0000 0000 9995 | Insufficient funds |

After testing, switch to live mode in your Stripe dashboard. Replace test API keys with live ones. Your Stripe integration is now ready for use.

Payment Processing Features

Stripe offers many payment processing features. These features make it easy to accept payments from customers. Stripe’s tools help manage transactions smoothly. This section will cover some key features.

Accepted Payment Methods

Stripe supports a variety of payment methods. This ensures customers can choose their preferred way to pay. Here are some common payment methods:

- Credit and Debit Cards: Visa, MasterCard, American Express, and more

- Digital Wallets: Apple Pay, Google Pay, and Microsoft Pay

- Bank Transfers: ACH, SEPA, and other bank transfer options

- Buy Now, Pay Later: Klarna, Afterpay, and Affirm

Using multiple payment methods can increase sales. Customers appreciate having options. Stripe makes it easy to add these methods to your site.

Handling Transactions

Stripe’s tools help handle transactions efficiently. This ensures a smooth payment experience for customers. Here are some important features:

- Real-time Monitoring: Track payments as they happen. Get instant notifications for each transaction.

- Fraud Prevention: Stripe uses advanced algorithms to detect fraud. This helps keep your business safe.

- Automatic Payouts: Set up automatic transfers to your bank account. Choose daily, weekly, or monthly payouts.

- Dispute Management: Easily manage and respond to disputes. Stripe provides tools to help resolve issues quickly.

These features save time and reduce stress. They help ensure your business runs smoothly. Stripe’s transaction tools are designed to be user-friendly and efficient.

By using Stripe’s payment processing features, you can provide a seamless payment experience for your customers. This can lead to higher satisfaction and more sales.

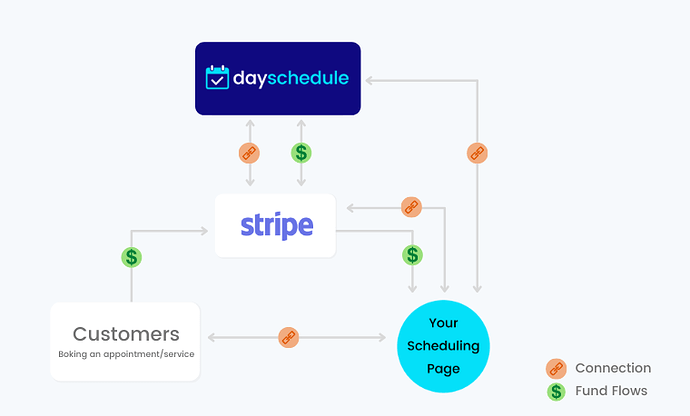

Credit: dayschedule.com

Managing Payments And Refunds

Managing payments and refunds is a crucial part of any business that accepts online transactions. Stripe makes this process seamless and efficient. In this section, we will discuss tracking payments and issuing refunds using Stripe’s features.

Tracking Payments

Stripe offers a detailed dashboard to help you track payments. This dashboard provides real-time data and insights. You can view all transactions, including successful payments, pending payments, and failed attempts.

Here are some key features of the Stripe dashboard:

- Transaction History: Access a complete history of all your transactions.

- Payment Status: Easily see the status of each payment.

- Filters and Search: Use filters and search options to find specific transactions.

These tools help you manage your finances and identify any issues quickly.

Issuing Refunds

Issuing refunds is straightforward with Stripe. The platform allows you to process refunds directly from the dashboard. You can choose between full and partial refunds based on your needs.

Steps to issue a refund:

- Log in to your Stripe dashboard.

- Navigate to the Payments section.

- Find the transaction you want to refund.

- Click on the transaction and select Issue a refund.

- Choose the amount and confirm the refund.

Stripe processes refunds quickly, ensuring customer satisfaction. The refunded amount is usually returned to the customer’s account within a few business days.

Advanced Integration Options

Integrating Stripe into your website offers various advanced options. These options help you customize the payment process. From personalizing the checkout experience to handling recurring payments, Stripe provides flexibility and control. Let’s explore some advanced integration options in detail.

Customizing The Checkout

Stripe allows you to customize the checkout experience. This ensures it matches your brand’s identity. You can change colors, fonts, and layout to fit your website’s design. Using Stripe’s API, you can create a seamless and unique checkout process.

Here is a basic example to customize your checkout:

Recurring Payments

Recurring payments are crucial for subscription-based businesses. Stripe offers robust tools to manage subscriptions. You can set up recurring billing cycles, apply discounts, and handle upgrades or downgrades.

To create a subscription, use the following code:

Using these options, you can manage and optimize customer payments. Customizing the checkout and handling recurring payments become seamless.

Troubleshooting Common Issues

Integrating Stripe for payments can streamline your business. But, issues can arise. Knowing how to troubleshoot helps maintain smooth operations. Below, we discuss common errors and how to get customer support.

Common Errors

Encountering errors during Stripe integration? Here are some typical ones:

- API Key Errors: Double-check if your API keys are correct. Use test keys in a development environment.

- Webhook Issues: Ensure your webhook URL is publicly accessible. Verify endpoint configuration.

- Card Declines: Card declines can happen for various reasons. Check error messages in the response.

- Authentication Failures: Confirm that your account credentials are accurate.

Addressing these issues promptly can save time and reduce frustration. Always refer to Stripe’s documentation for detailed guidance.

Customer Support

Need help beyond the documentation? Stripe offers several support channels:

- Email Support: Reach out via email for detailed queries.

- Live Chat: Use live chat for real-time assistance.

- Community Forums: Engage with other users in the community forums.

For urgent issues, live chat can be the fastest way to get help. Always keep your account details handy.

Future Trends In Payment Integration

The future of payment integration is rapidly evolving. New technologies and trends are shaping the way we handle transactions. Stripe, a leading payment processor, is at the forefront of these changes. Understanding these trends can help businesses stay ahead.

Emerging Technologies

Several emerging technologies are impacting payment integration. Below are some key technologies to watch:

- Blockchain: Blockchain technology offers secure and transparent transactions. It can reduce fraud and increase trust.

- Artificial Intelligence (AI): AI can predict user behavior and personalize payment experiences. This can improve customer satisfaction.

- Internet of Things (IoT): IoT devices can enable seamless payments. Smart devices can automatically process transactions, making payments more convenient.

- Biometric Authentication: Fingerprint and facial recognition can enhance security. They provide an extra layer of protection for users.

These technologies are not just trends. They are shaping the future of payments.

Predictions For Stripe

Stripe continues to innovate in the payment processing industry. Here are some predictions for Stripe:

- Expansion into New Markets: Stripe is likely to expand into more global markets. This will make it easier for businesses to accept payments worldwide.

- Enhanced Security Features: Stripe will focus on improving security. Expect more advanced fraud detection and prevention tools.

- Increased Use of Machine Learning: Machine learning will help Stripe offer better insights. Businesses can use these insights to optimize their payment processes.

- Integration with More Platforms: Stripe will integrate with more e-commerce and financial platforms. This will offer businesses greater flexibility and choice.

Stripe’s focus on innovation ensures that it will remain a key player in the payment industry. By staying aware of these trends and predictions, businesses can better prepare for the future.

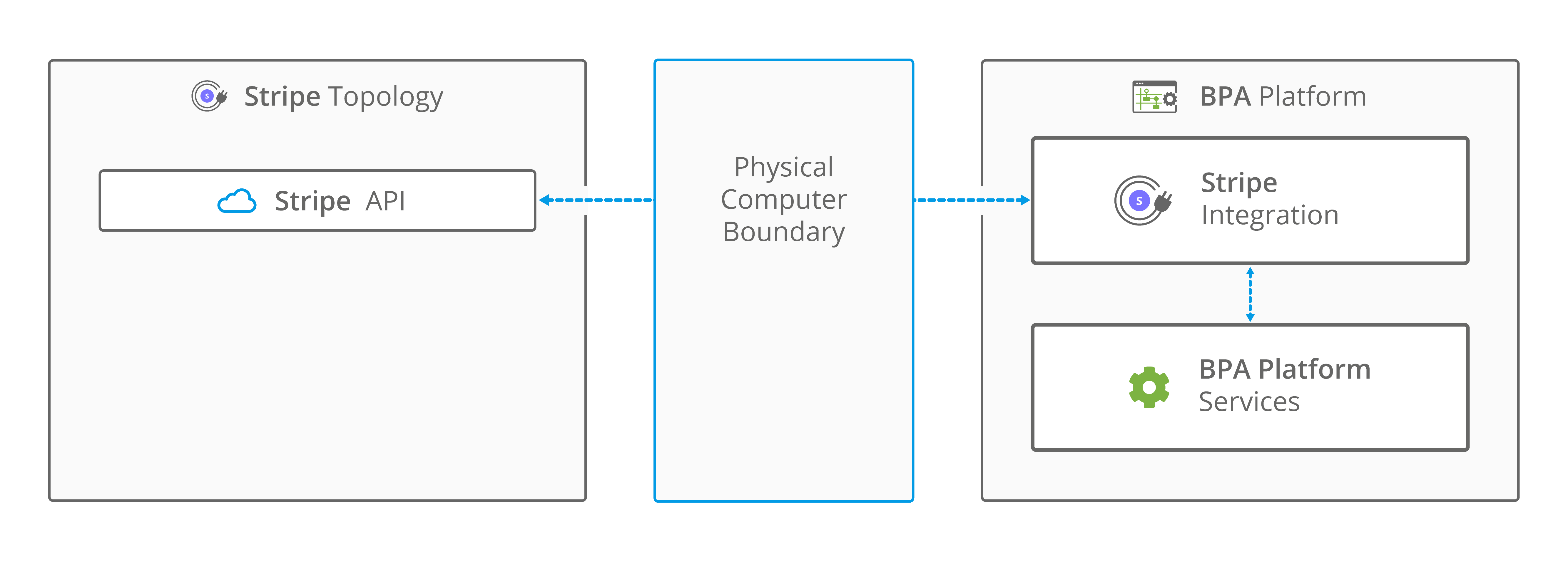

Credit: www.codelessplatforms.com

Frequently Asked Questions

What Is Stripe Payment Integration?

Stripe payment integration allows you to accept online payments on your website. It’s secure and efficient.

How Do I Set Up Stripe For My Website?

Create a Stripe account, get API keys, and integrate them with your website’s payment system.

Is Stripe Safe For Online Transactions?

Yes, Stripe uses advanced encryption and security measures to protect online transactions.

What Currencies Does Stripe Support?

Stripe supports over 135 currencies. You can accept payments from around the world.

Can I Use Stripe With WordPress?

Yes, Stripe has plugins for WordPress. It easily integrates with popular e-commerce platforms.

Does Stripe Charge Transaction Fees?

Yes, Stripe charges a fee per transaction. The exact fee depends on your country and currency.

How Long Does It Take To Receive Funds From Stripe?

Stripe usually transfers funds to your bank account within 2-7 business days.

Conclusion

Integrating Stripe payments enhances your website’s functionality and user experience. The process is straightforward and beneficial. Stripe offers secure transactions, ensuring customer trust. By adding Stripe, you cater to diverse payment methods. This integration supports business growth and customer satisfaction.

Explore Stripe’s features and see positive results. Implement Stripe today for a smoother checkout process. Your users will appreciate the convenience and security.