In today’s digital age, businesses need efficient payment solutions. Mollie Payment Processor stands out as a top choice.

Mollie offers easy-to-use payment services for online businesses. Whether you’re a small startup or a large enterprise, Mollie can simplify your transactions. With its user-friendly interface and robust security features, Mollie ensures smooth and safe payments. It supports various payment methods, making it versatile for global customers.

This flexibility helps businesses cater to diverse audiences with ease. Mollie’s transparent pricing and no hidden fees policy also attract many business owners. By integrating Mollie, companies can focus more on growth and less on payment hassles. So, let’s explore why Mollie Payment Processor might be the perfect fit for your business needs.

Introduction To Mollie

Mollie is a popular payment processor. It helps businesses accept payments online. With Mollie, companies can easily handle transactions. It supports many payment methods. This makes it a good choice for businesses of all sizes.

What Is Mollie?

Mollie is a payment service provider. It helps businesses manage online payments. Mollie supports credit cards, bank transfers, and other payment methods. This makes it flexible and user-friendly. Mollie aims to simplify payment processing.

History And Growth

Mollie started in 2004. It began in the Netherlands. Over the years, Mollie has grown rapidly. Today, it serves thousands of businesses across Europe. Mollie’s growth shows its reliability and effectiveness.

| Year | Milestone |

|---|---|

| 2004 | Mollie was founded |

| 2011 | Expanded to support more payment methods |

| 2018 | Reached over 65,000 customers |

| 2021 | Served over 130,000 businesses across Europe |

Throughout its history, Mollie has focused on innovation. It continually adds new features. This helps businesses stay competitive. Mollie’s user-friendly platform is a key factor in its success.

Credit: profilepress.com

Setting Up Mollie

Setting up Mollie is a straightforward process. It involves creating an account and integrating it with your website or application. This guide covers the essential steps to get you started with Mollie.

Account Creation

To begin using Mollie, you need to create an account. Follow these steps:

- Visit the Mollie website.

- Click on the “Sign Up” button at the top right corner.

- Fill in your email address and create a password.

- Confirm your email address by clicking the link sent to your inbox.

- Complete your profile by providing necessary details such as your company name and address.

Once your account is created, you can access the Mollie dashboard. Here, you can manage your payment methods, view transactions, and more.

Integration Options

Mollie offers various integration options to suit different needs. These include:

- API Integration: For developers who want full control over their payment processes.

- Payment Plugins: Pre-built plugins for popular platforms like WooCommerce, Shopify, and Magento.

- Hosted Payment Pages: Simple to set up and requires no coding skills.

Each integration option provides detailed documentation. Below is a table summarizing the key features of each option:

| Integration Option | Best For | Key Features |

|---|---|---|

| API Integration | Developers | Full control, customizable, detailed documentation |

| Payment Plugins | Shop Owners | Easy installation, no coding required, supports multiple platforms |

| Hosted Payment Pages | Non-technical Users | Quick setup, secure, no coding required |

Choose the integration option that best fits your needs. Follow the provided instructions to complete the setup.

Key Features

Mollie Payment Processor stands out with its impressive features. It offers numerous benefits for businesses of all sizes. Let’s explore the key features that make Mollie a popular choice.

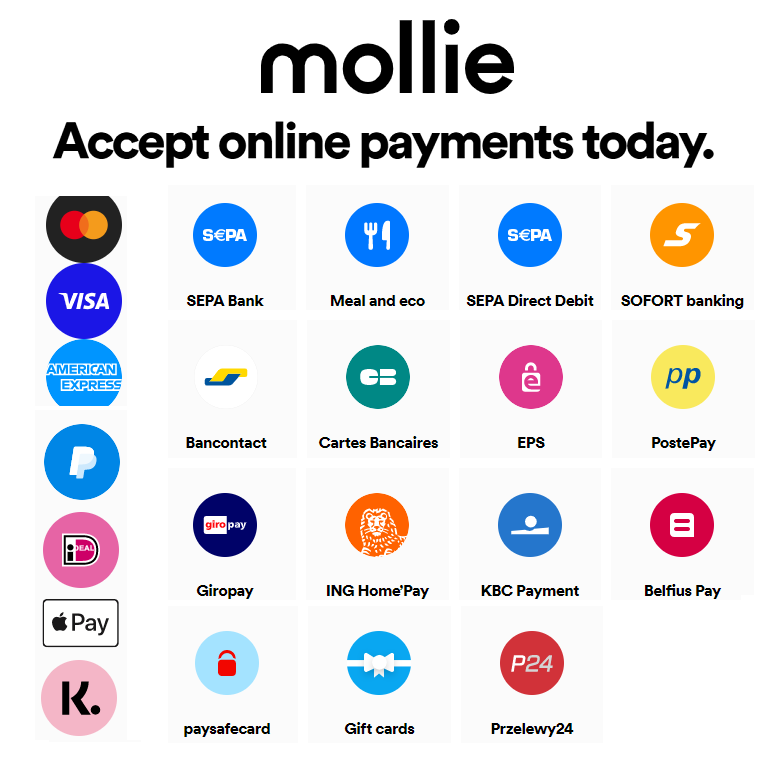

Payment Methods

Mollie supports various payment methods. This ensures a convenient experience for customers and merchants alike. Here are the main payment methods available:

- Credit and Debit Cards: Accept payments from major card providers like Visa and Mastercard.

- Bank Transfers: Enable direct transfers from customer bank accounts.

- PayPal: Integrate with PayPal for a seamless payment process.

- Apple Pay and Google Pay: Allow customers to pay using their mobile wallets.

- Local Payment Methods: Support region-specific options like iDEAL in the Netherlands.

Offering multiple payment methods can increase customer satisfaction. It also helps in reducing cart abandonment rates.

Security Measures

Security is a top priority for Mollie. It ensures that all transactions are safe and secure. Key security measures include:

- PCI-DSS Compliance: Mollie complies with the highest standards for payment security.

- Fraud Prevention: Advanced fraud detection tools protect businesses from fraudulent transactions.

- Data Encryption: All sensitive data is encrypted to prevent unauthorized access.

- Two-Factor Authentication: Adds an extra layer of security for account access.

These security measures help build trust with customers. It also ensures the safety of sensitive information.

| Feature | Description |

|---|---|

| Payment Methods | Supports various methods like cards, bank transfers, and mobile wallets. |

| Security Measures | Includes PCI-DSS compliance, fraud prevention, and data encryption. |

Credit: hostbillapp.com

User Experience

The user experience of a payment processor is crucial for businesses. Mollie Payment Processor aims to provide a seamless experience for its users. Let’s explore its features.

Dashboard Overview

The Mollie Dashboard is intuitive and user-friendly. It offers a clear overview of your transactions and payments. Users can easily navigate through various sections.

Here are some key features of the dashboard:

- Real-time analytics: View live updates on payments and transactions.

- Customizable reports: Generate reports based on your business needs.

- Transaction history: Access detailed records of all past transactions.

These features help you keep track of your financial activities with ease.

Customer Support

Mollie provides excellent customer support to ensure a smooth user experience. They offer multiple support channels including:

- Live chat: Get instant help from support agents.

- Email support: Receive detailed responses to your queries.

- Help center: Access a comprehensive knowledge base.

Additionally, their response times are quick, ensuring minimal disruption to your business operations.

Here’s a summary of their support channels:

| Support Channel | Availability |

|---|---|

| Live Chat | 24/7 |

| Email Support | 24/7 |

| Help Center | Always Accessible |

With these options, Mollie ensures that users have the support they need, whenever they need it.

Pricing Structure

Understanding the pricing structure of Mollie Payment Processor is essential. It helps businesses manage costs efficiently. Mollie offers transparent pricing. This ensures no hidden fees. Let’s break down the fee structure and compare it to competitors.

Fee Breakdown

Mollie charges fees based on the payment method. Each method has its own rate. Here’s a table to illustrate the fees:

| Payment Method | Fee |

|---|---|

| Credit Card | 2.9% + €0.25 per transaction |

| iDEAL | €0.29 per transaction |

| PayPal | 3.4% + €0.35 per transaction |

| Sofort | 0.9% + €0.25 per transaction |

| Bancontact | 1.8% + €0.20 per transaction |

Mollie does not charge for setup or monthly fees. This makes it cost-effective for small businesses.

Comparisons

How does Mollie stack up against other payment processors? Let’s compare it with Stripe and PayPal.

- Stripe: Charges 2.9% + €0.30 per transaction for credit cards. No setup or monthly fees.

- PayPal: Charges 3.9% + €0.35 per transaction for credit cards. No setup or monthly fees.

Mollie’s fees for some methods are lower than Stripe and PayPal. For example, iDEAL transactions cost €0.29 with Mollie, compared to Stripe’s 2.9% + €0.30.

Choosing the right payment processor depends on your business needs. Consider the volume of transactions and preferred payment methods.

Use Cases

Mollie Payment Processor offers versatile solutions for various business needs. Let’s explore some of its key use cases.

E-commerce

Mollie is perfect for e-commerce businesses. It enables smooth transactions and supports multiple payment methods. Here are some benefits for e-commerce:

- Accepts credit and debit cards, PayPal, and more

- Supports local and international payments

- Easy integration with popular platforms like Shopify and WooCommerce

With Mollie, you can provide a seamless checkout experience for your customers. This leads to higher conversion rates and customer satisfaction.

Subscriptions

Mollie also excels in handling subscriptions. It simplifies the process of managing recurring payments. Key features include:

- Automated billing cycles

- Support for various subscription models

- Real-time payment status updates

Using Mollie for subscriptions ensures timely payments and reduces administrative workload. This allows you to focus on growing your business.

Pros And Cons

Understanding the advantages and disadvantages of using Mollie Payment Processor is essential for any business. Let’s dive into the pros and cons of this service.

Advantages

Mollie offers several benefits that make it a popular choice for businesses:

- Easy Integration: Mollie provides simple integration with various platforms and e-commerce sites.

- Transparent Pricing: The pricing structure is clear, with no hidden fees.

- Multiple Payment Methods: Mollie supports various payment methods, including credit cards, PayPal, and bank transfers.

- Secure Transactions: Mollie ensures secure transactions with robust security measures.

- International Reach: Businesses can accept payments from customers worldwide.

Disadvantages

While Mollie has many strengths, there are some drawbacks to consider:

- Transaction Fees: Each transaction incurs a fee, which can add up for high-volume businesses.

- Limited Customer Support: Some users report slow response times from customer support.

- Geographic Restrictions: Not all payment methods are available in every country.

- Complex Fee Structure: The fee structure can be complex for certain payment methods.

- No Recurring Billing: Mollie does not support recurring billing for subscriptions.

Future Developments

The landscape of payment processing is ever-evolving. Mollie Payment Processor consistently stays ahead with new innovations. In this section, we will explore the future developments of Mollie.

Upcoming Features

Mollie is working on several exciting features set to launch soon. These enhancements aim to improve user experience and streamline transactions. Here are some key features to watch out for:

- Enhanced Security Protocols: Implementing advanced encryption techniques to safeguard transactions.

- Faster Payment Processing: Reducing transaction times to ensure quick transfers.

- Expanded Payment Methods: Adding support for more global payment options.

These features will make Mollie more versatile and user-friendly.

Industry Trends

The payment processing industry is shifting rapidly. Keeping up with these trends ensures Mollie remains competitive. Some key trends include:

| Trend | Description |

|---|---|

| Blockchain Integration | Utilizing blockchain for secure and transparent transactions. |

| AI in Fraud Detection | Using AI to identify and prevent fraudulent activities. |

| Mobile Payments | Increasing reliance on mobile devices for transactions. |

Adapting to these trends will help Mollie stay ahead in the market.

Credit: www.nopcommerce.com

Frequently Asked Questions

What Is Mollie Payment Processor?

Mollie is an online payment processor. It helps businesses accept payments from customers.

How Does Mollie Work?

Mollie integrates with your website. It lets customers pay using various methods like credit cards and PayPal.

Is Mollie Secure For Online Payments?

Yes, Mollie is very secure. It uses advanced encryption to protect your payment information.

Can I Use Mollie For My Online Store?

Yes, Mollie supports many e-commerce platforms. It is easy to set up and use.

What Payment Methods Does Mollie Support?

Mollie supports credit cards, bank transfers, PayPal, and more. It covers many popular payment methods.

Does Mollie Charge Transaction Fees?

Yes, Mollie charges a small fee per transaction. Fees vary based on payment method used.

How Do I Start Using Mollie?

Sign up on Mollie’s website. Follow the setup instructions to integrate it with your store.

Conclusion

Mollie payment processor simplifies transactions for businesses. Easy setup. Flexible options. Secure. With Mollie, you can focus on growth. No more payment headaches. Enjoy seamless integration. Start accepting payments effortlessly. Mollie supports your business needs. Make transactions smooth and hassle-free.

Choose Mollie for reliable payment solutions. Your business deserves the best. Give Mollie a try today.