Authorize.Net is a popular payment gateway service. It helps businesses process payments securely.

Authorize.Net features include secure payment processing. In today’s digital age, having a reliable payment gateway is crucial for any business. Authorize. Net stands out with its robust features designed to make payment processing seamless and secure. From fraud detection to recurring billing, it offers tools that cater to various business needs.

Whether you run a small online store or a large enterprise, understanding the features of Authorize. Net can help you make informed decisions. In this blog post, we will explore the key features of Authorize. Net, highlighting how they can benefit your business and enhance your payment processing experience. Stay tuned to learn more about this essential tool for modern commerce.

Credit: www.swipesum.com

Introduction To Authorize.net

Authorize.Net is a leading payment gateway. It helps businesses accept online payments securely. This service has been trusted for years by many companies.

What Is Authorize.net?

Authorize.Net is a payment gateway service provider. It allows merchants to accept credit card and electronic check payments. Established in 1996, it has grown to support over 440,000 merchants. The platform is known for its reliability and security.

Authorize.Net offers various features, including fraud detection, recurring billing, and secure customer data storage. These features help businesses manage their payments efficiently. The service integrates with many shopping carts and e-commerce platforms.

Importance Of Payment Gateways

Payment gateways are crucial for online businesses. They process and authorize transactions between the customer and the merchant. This ensures that payments are secure and efficient.

Using a payment gateway like Authorize.Net provides several benefits:

- Security: Protects customer payment information with advanced encryption.

- Convenience: Allows customers to pay using various methods, including credit cards and electronic checks.

- Efficiency: Streamlines the payment process, reducing the time and effort needed to handle transactions.

Choosing the right payment gateway can impact your business’s success. Authorize.Net is a trusted option for many companies. It offers reliability, security, and a range of features to support your payment needs.

Setting Up Authorize.net

Setting up Authorize.Net is a straightforward process. This guide will help you create an account and integrate the API. Let’s begin with the basics of account creation and API integration.

Account Creation

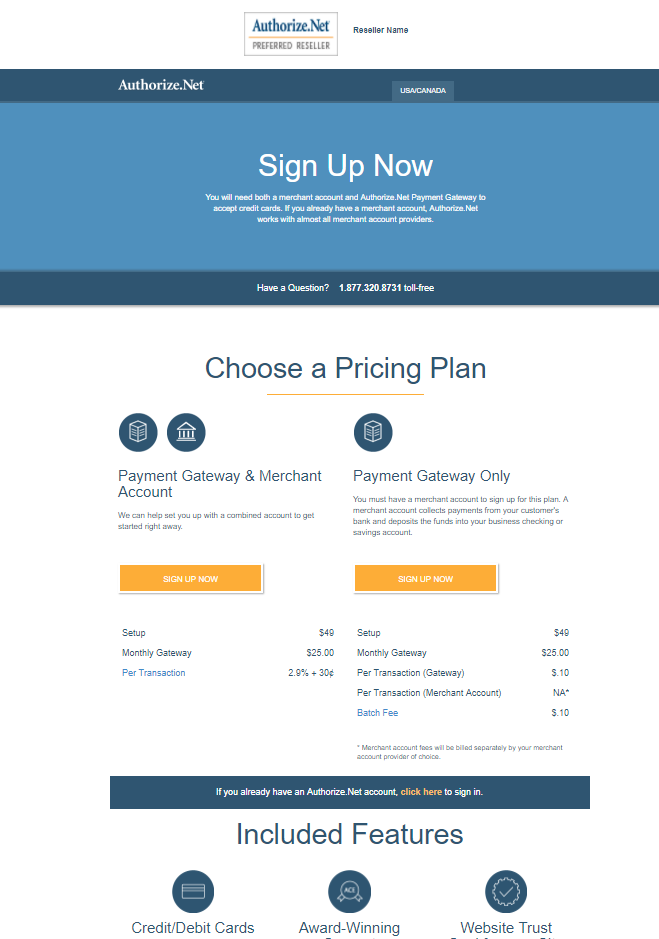

To start, you need to create an account. Follow these steps:

- Go to the Authorize.Net website.

- Click on the “Sign Up” button.

- Fill in your personal and business information.

- Choose a pricing plan that suits your needs.

- Submit the form and verify your email address.

Once your account is verified, you can access your dashboard.

Api Integration

After creating an account, you need to integrate the API. Here’s how:

- Log in to your Authorize.Net account.

- Navigate to the “Account” section.

- Select “API Credentials & Keys”.

- Generate a new API key and note the credentials.

Now, integrate the API into your website or app. Use the provided API documentation for guidance. Here are some key points:

- Include the API key in your code.

- Use secure connections (HTTPS) for transactions.

- Test the integration in a sandbox environment.

Once everything is set, switch to live mode to start processing payments.

Below is an example of a basic API request code:

{

"createTransactionRequest": {

"merchantAuthentication": {

"name": "YOUR_API_LOGIN_ID",

"transactionKey": "YOUR_TRANSACTION_KEY"

},

"transactionRequest": {

"transactionType": "authCaptureTransaction",

"amount": "5.00",

"payment": {

"creditCard": {

"cardNumber": "4111111111111111",

"expirationDate": "2025-12"

}

}

}

}

}

https://www.youtube.com/watch?v=

Payment Processing

Authorize.Net offers a wide array of payment processing features that simplify transactions for businesses. From credit card payments to eCheck processing, Authorize.Net provides secure and efficient solutions. Let’s delve into the specifics of these features.

Credit Card Payments

Accepting credit card payments is crucial for any business. Authorize.Net supports major credit cards including Visa, MasterCard, American Express, and Discover. This ensures a seamless experience for customers.

Authorize.Net provides a secure platform for processing credit card transactions. It uses advanced encryption technology to protect sensitive data. Merchants can also set up recurring billing. This is ideal for subscription-based services.

Additionally, Authorize.Net offers fraud detection tools. These tools help to minimize the risk of fraudulent transactions. They provide real-time alerts for suspicious activities.

| Feature | Description |

|---|---|

| Major Credit Card Support | Visa, MasterCard, American Express, Discover |

| Advanced Encryption | Protects sensitive data during transactions |

| Recurring Billing | Ideal for subscription-based services |

| Fraud Detection | Provides real-time alerts for suspicious activities |

Echeck Processing

eCheck processing allows businesses to accept payments directly from bank accounts. This feature is particularly useful for businesses dealing with large transactions.

With Authorize.Net’s eCheck processing, funds are transferred electronically. This reduces the need for paper checks. It also speeds up the transaction process.

eCheck processing is secure and reliable. Authorize.Net uses verification processes to ensure the validity of bank account details. This reduces the chances of payment failures.

Here are the key benefits of eCheck processing:

- Reduced paper usage

- Faster transaction times

- Secure and reliable

- Verification processes to ensure valid transactions

eCheck processing can streamline your payment workflow. This makes it easier for both businesses and customers.

Credit: developer.authorize.net

Security Features

Authorize.Net is a leading payment gateway that offers robust security features. These features ensure safe and secure transactions. Here, we will explore two key aspects: fraud detection and data encryption.

Fraud Detection

Fraud detection is crucial for any online business. Authorize.Net provides advanced tools to detect and prevent fraud.

- Address Verification Service (AVS): Compares the billing address provided with the address on file with the card issuer.

- Card Code Verification (CVV): Checks the card’s CVV code to ensure it is valid.

- Fraud Detection Suite: Offers customizable filters and tools to identify suspicious transactions.

These tools help minimize fraudulent activities and protect your business. They provide peace of mind for both merchants and customers.

Data Encryption

Data encryption ensures that sensitive information is secure during transmission.

Authorize.Net uses Transport Layer Security (TLS) to encrypt data. This is the same technology used by banks and financial institutions.

Encryption converts data into a secure format. This makes it unreadable to unauthorized users. Only authorized parties can access the information.

Here are the key benefits of data encryption with Authorize.Net:

- Confidentiality: Protects sensitive customer information.

- Integrity: Ensures data is not altered during transmission.

- Authentication: Verifies the identity of the parties involved in the transaction.

By using data encryption, Authorize.Net ensures that your transactions are safe and secure.

Recurring Billing

Recurring billing is a powerful feature of Authorize.Net that simplifies the payment process for businesses. It enables businesses to automatically charge their customers on a regular basis. This feature is perfect for subscription-based services and membership sites.

Subscription Management

With Authorize.Net, managing subscriptions is straightforward. You can easily set up and manage multiple subscription plans. This includes:

- Custom billing intervals

- Flexible pricing options

- Automated notifications

Businesses can also offer trials and discounts. Customers appreciate the flexibility and transparency.

Automated Payments

Automated payments save time and reduce errors. Authorize.Net handles the billing process for you. Key features include:

| Feature | Benefit |

|---|---|

| Automatic Invoicing | Increases efficiency |

| Secure Transactions | Protects customer data |

| Payment Reminders | Improves cash flow |

With automated payments, businesses can focus on growth. Customers enjoy hassle-free payment experiences.

Credit: baremetrics.com

Reporting And Analytics

Reporting and analytics play a crucial role in managing your business. Authorize.Net offers comprehensive tools that help you track and analyze transactions efficiently. These features enable you to gain valuable insights, optimize operations, and make data-driven decisions.

Transaction Reports

With Authorize.Net, you can access detailed transaction reports. These reports offer a clear view of your sales performance. You can easily monitor daily, weekly, and monthly transactions.

- View transaction history

- Identify trends in sales

- Track refunds and chargebacks

The platform provides various filters to refine your reports. You can filter by date range, transaction type, and payment method. This helps you to pinpoint specific details and identify patterns.

Customer Insights

Authorize.Net also helps you understand your customers better. The customer insights feature provides valuable data about your buyers. You can learn about their purchasing habits and preferences.

- Track customer purchase frequency

- Analyze average transaction value

- Identify repeat customers

This information allows you to tailor your marketing efforts. You can create personalized offers and improve customer retention. Authorize.Net makes it easy to keep your customers happy and engaged.

Mobile Payments

Mobile Payments are a crucial feature of Authorize.Net, enabling businesses to accept payments on-the-go. This flexibility is essential for businesses with mobile operations or those looking to offer convenience to their customers.

Mobile App Integration

With Mobile App Integration, Authorize.Net makes it easy to accept payments from anywhere. The platform provides a user-friendly mobile app compatible with both iOS and Android devices.

Some key features include:

- Real-time transaction processing

- Secure data encryption

- Customizable receipts

- Transaction history and reporting

The app’s intuitive design ensures that business owners can manage transactions efficiently. This helps in streamlining operations and improving customer satisfaction.

In-app Purchases

Authorize.Net supports In-App Purchases, a valuable feature for businesses with a mobile application. This allows customers to buy products or services directly within the app.

Benefits of this feature include:

- Simplified purchase process

- Enhanced user experience

- Increased sales opportunities

- Secure payment processing

By integrating in-app purchases, businesses can offer a seamless buying experience. This not only boosts customer engagement but also encourages repeat purchases.

Advanced Tools

Authorize.Net offers a range of advanced tools to enhance your payment processing experience. These tools provide extra functionality and control, making it easier to manage transactions. Let’s explore two key features: Customer Information Manager and Virtual Terminal.

Customer Information Manager

The Customer Information Manager (CIM) allows you to store and manage customer payment information securely. This tool helps in reducing PCI compliance scope by storing sensitive data on Authorize.Net’s secure servers.

- Store payment methods securely

- Create customer profiles

- Manage billing and shipping information

CIM makes it easy to handle recurring transactions and offers a seamless checkout experience for repeat customers. By using CIM, you can also speed up the payment process, as customers do not need to re-enter their payment details each time.

Virtual Terminal

The Virtual Terminal is a web-based interface that allows you to process transactions manually. This is especially useful for businesses that accept payments over the phone or by mail.

- Process credit card payments

- Accept eCheck payments

- Generate transaction reports

With the Virtual Terminal, you can easily enter payment details and complete transactions from any computer with internet access. This flexibility ensures you can manage payments efficiently, even without a physical point-of-sale system.

Both the Customer Information Manager and Virtual Terminal are essential tools within Authorize.Net’s suite of features. They enhance the payment processing experience, making it more streamlined and secure for both businesses and customers.

Customer Support

One of the standout features of Authorize.Net is its exceptional Customer Support. Businesses need reliable support to handle their payment processing issues. Authorize.Net delivers just that with round-the-clock assistance and a wealth of resources.

24/7 Assistance

Authorize.Net offers 24/7 customer support to ensure you have help anytime you need it. Whether it’s day or night, their team is ready to assist. This includes weekends and holidays. You can contact them through multiple channels:

- Phone support for immediate help.

- Email support for detailed inquiries.

- Live chat for quick questions and answers.

Having access to 24/7 support can save you from potential disruptions. It helps keep your business running smoothly at all times.

Resource Center

Authorize.Net also has a comprehensive Resource Center. This is a hub of useful information. You can find:

- Guides on setting up and using their services.

- FAQs for quick answers to common questions.

- Tutorials that walk you through various processes.

- Webinars and training sessions to enhance your knowledge.

These resources are designed to help you make the most of Authorize.Net’s features. They provide valuable insights and step-by-step instructions. You can solve many issues on your own by referring to this center.

Frequently Asked Questions

What Is Authorize.net?

Authorize. Net is a payment gateway service. It helps businesses process online transactions securely.

How Does Authorize.net Work?

Authorize. Net connects your website to payment processing networks. It ensures transactions are safe and reliable.

Is Authorize.net Easy To Set Up?

Yes, Authorize. Net is user-friendly. It offers step-by-step guides and support for easy setup.

Can I Use Authorize.net With My Shopping Cart?

Yes, Authorize. Net supports most major shopping carts. It integrates seamlessly with many e-commerce platforms.

Does Authorize.net Support Recurring Billing?

Yes, it does. Authorize. Net offers a recurring billing feature. It helps manage subscription services efficiently.

What Security Features Does Authorize.net Offer?

Authorize. Net provides advanced fraud detection tools. It ensures customer data is protected during transactions.

How Much Does Authorize.net Cost?

Authorize. Net charges a monthly fee and transaction fees. Costs vary based on your business needs.

Conclusion

Authorize. Net offers a variety of useful features for businesses. It simplifies online transactions and enhances security. Merchants can easily manage payments and reduce fraud risks. The user-friendly interface ensures smooth operations for all. Understanding these features helps in making informed decisions.

Businesses of all sizes can benefit from using Authorize. Net. Its flexibility and reliability make it a valuable tool. Explore these features to improve your payment processes.